Sacco/MFI Software

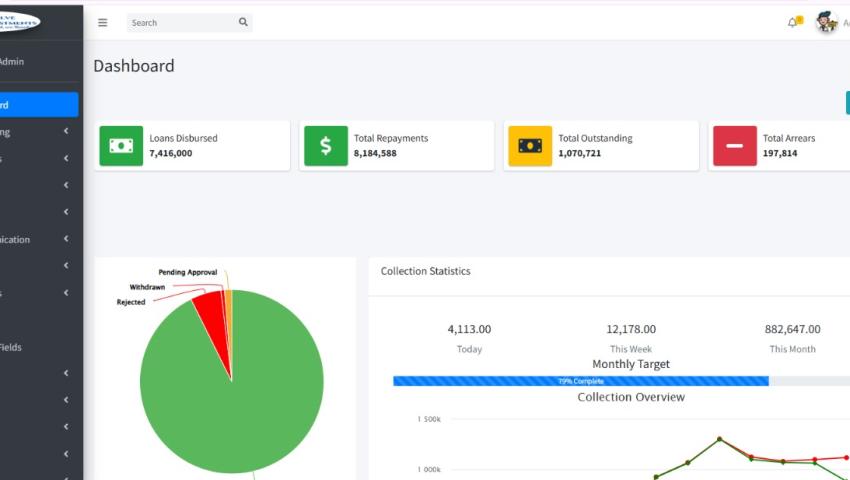

CorePlus® suite offers an intuitive platform for end-to-end loan lifecycle management, with customizable modules for microfinance needs, integrating seamlessly with accounting and reporting tools.

SACCO Management System & CrePlus Loan Management System: Features and Modules Overview

The SACCO Management System is a specialized software solution designed to automate and simplify financial operations for Savings and Credit Cooperative Organizations (SACCOs) in Kenya, enhancing member services and regulatory compliance. Complementing it, CorePlus® suite is an affordable online loan management system that streamlines borrower handling, loan processing, and collections for microfinance and lending businesses. Both tools promote efficiency, transparency, and user-friendly workflows, ideal for Kenyan financial cooperatives and institutions.

CorePlus® suite SACCO Management System

This system centralizes member data, automates transactions, and generates compliance-ready reports, supporting FOSA (Front Office Service Activity) and BOSA (Back Office Service Activity) operations.

| Module/Feature | Key Features | Benefits |

|---|---|---|

| Member Registration & Management | - Effortless enrollment with personal and KYC details - Profile updates and status tracking - Next-of-kin and contact management | Simplifies onboarding, ensures accurate member records, and facilitates personalized services for SACCO growth. |

| Savings & Contributions Tracking | - Automated deposit/withdrawal processing - Contribution schedules and reminders - Balance inquiries via mobile/SMS | Automates routine transactions, reduces errors, and boosts member engagement through real-time tracking. |

| Loan Processing & Repayment Management | - Quick approval workflows with risk assessment - Repayment scheduling and automated deductions - Arrears monitoring and recovery tools | Speeds up lending decisions, minimizes defaults, and ensures steady cash flow for SACCO sustainability. |

| Financial Reporting | - Real-time statements (balance sheets, P&L) - Customizable dashboards and audit trails - Exportable reports for KRA compliance | Provides actionable insights, supports regulatory filings, and enhances transparency for stakeholders. |

| Secure & User-Friendly | - Role-based access and data encryption - Intuitive interface with mobile compatibility - Backup and recovery features | Protects sensitive data, eases staff training, and ensures reliable operations even in low-connectivity areas. |

CorePlus® suite offers an intuitive platform for end-to-end loan lifecycle management, with customizable modules for microfinance needs, integrating seamlessly with accounting and reporting tools.

| Module/Feature | Key Features | Benefits |

|---|---|---|

| Intuitive & User-Friendly | - One/two-click functions and clear UI - Guided workflows for core processes - Always-accessible data dashboards | Reduces learning curve, accelerates daily tasks, and minimizes errors in fast-paced lending environments. |

| Borrowers Management | - Capture of personal, business, and KYC info - Document/photo uploads and custom fields - Next-of-kin and identifier tracking | Centralizes client data for quick access, supports compliance, and enables tailored lending decisions. |

| Loans & Savings | - Flexible terms, rates, schedules, and charges - Customizable interest methods and approvals - Savings integration with loan products | Adapts to diverse microfinance models, streamlines disbursements, and optimizes portfolio performance. |

| Accounting | - Configurable chart of accounts with GL codes - Auto/manual journal entries (e.g., disbursements) - Reports like trial balance, balance sheet, P&L | Ensures accurate bookkeeping, automates financial postings, and supports integrated fiscal management. |

| Reports | - Borrower stats, portfolio overviews, arrears - Savings, payments, collections, provisioning sheets - High-quality exports (PDF/Excel) | Delivers comprehensive analytics, aids risk assessment, and facilitates strategic planning and audits. |

| Staff Management | - User permissions and role controls - Payroll setup and audit trails - Activity monitoring for accountability | Enhances team oversight, secures sensitive operations, and streamlines HR for small lending teams. |

CorePlus® suite, is tailored for SACCOs, chamas, microfinance institutions, and welfare groups, offering scalability from small community setups to larger cooperatives. Boost your financial operations.